One of the more pernicious aspects of the pandemic has been the widespread erosion of financial security. Regardless of our socioeconomic status, many of us have watched our peace of mind evaporate in recent months.

This is especially true—and especially urgent—for the families of college-bound high school seniors, who are now in the middle of application season and who are now discovering the degree to which the financial aid process has been impacted by COVID-19.

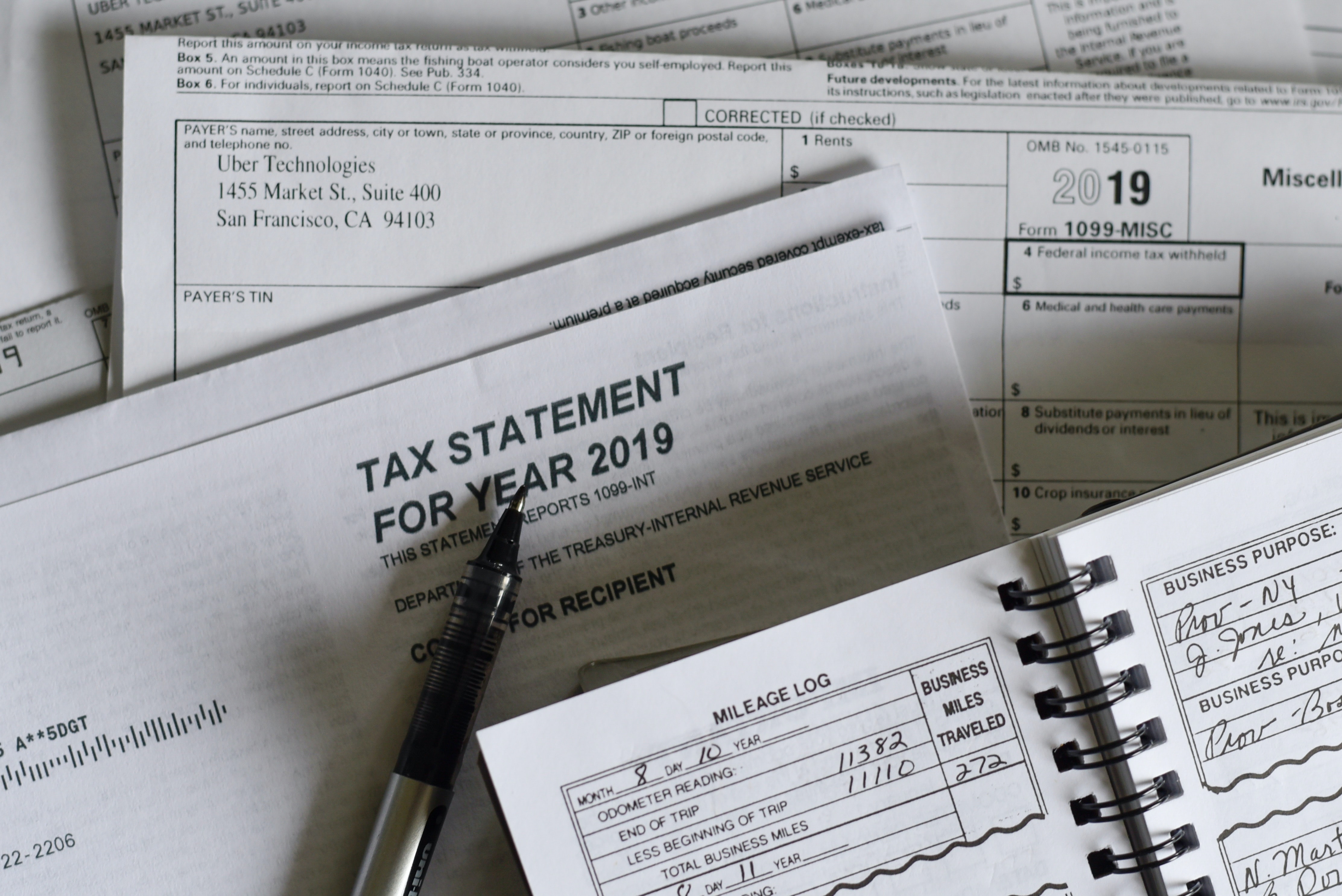

One of the more troublesome snags in the process is that FAFSA—the Free Application for Federal Student Aid, which opened October 1st—requires financial information from 2019. Whatever their income in 2019, many are now facing unemployment, or underemployment, or at least grave levels of uncertainty. Simply put, pre-pandemic financial information is not reflective of the precarious situation in which many families currently find themselves, nor does it paint an accurate picture of what they will be able to afford to pay for college.

Get the top stories in your inbox by signing up for our daily newsletter, Indy Today.

I recently spoke with Raúl Aguilera, a program advisor at the Scholarship Foundation of Santa Barbara, and he agreed that this was the number one question he has been receiving from families in the SB community. Parents are deeply worried about the financial commitment required at a four-year university when their family finances are so shaky.

So what should these families do?

“First, report early and accurately,” says Aguilera. “Then, after you fill out the FAFSA, contact the financial aid offices of the colleges you’re interested in.”The application is only part of the process, according to Aguilera. Colleges have a vested interest in understanding your situation as completely as possible, and in working to accommodate your needs.

They should also prepare to make their case in the event their financial aid offer falls short of their needs. This means gathering documentation that shows any loss of income due to COVID-19, and drafting an appeal letter to be used if financial aid awards do not match what they can afford.

Beyond that, families should exercise extreme diligence when it comes to understanding the real cost of college. As the Executive Directorof Mission Scholars, a Santa Barbara Education Foundation program that works with high-achieving students from families of limited economic means, a big part of my job—besides helping these students apply to college—is helping their families figure out how to afford it. Our program teaches families to itemize all their costs and go through them line by line.

For example, do you really need the more expensive meal plan the college added to your bill, or can you find a way to spend less on food the first year? Do you really need that double-occupancy dorm room the college automatically placed you in, or should you consider a less expensive option?

One of our Scholars recently saved more than $5000 by choosing to live in a co-op instead of a traditional dorm room. For some, this amount is a drop in the bucket; for her, it will make all the difference, enabling her to be the first in her family to graduate from a four-year university.

The thing to remember is that any family who is struggling should not simply accept what is offered to them. Poke, prod, and inquire: things are rarely etched in stone, especially nowadays.

Finally, please realize that you are not in this alone. There is broad support for higher education within the Santa Barbara community, and there are organizations that are eager to help.

Take Aguilera’s organization, for instance: the Scholarship Foundation of Santa Barbara can direct you to resources that can help you write the aforementioned appeal letters. “Once students actually get their financial aid, we always send those resources to them so that they can draft appeal forms based on their circumstances,” he says. SFSB can help in many other areas, too: it’s what they do. But it’s up to you to initiate contact.

There are other resources as well. Cal-SOAP, a state program with a local presence, offers tutoring services, college application help, and financial aid guidance. Students enrolled in PEAC (the Program for Effective Access to College) have a wealth of assistance at their beck and call, and of course, there are always your own school counselors, who are knowledgeable and motivated, and who should be kept in the loop throughout the process. Finally, there are the colleges themselves, who understand the current landscape and are often eager to help.

The takeaway here is that no family is alone in this process. No matter what your situation is, there are people and resources that can help you navigate what lies ahead—and, hopefully, help you regain some peace of mind.

Cassie Lancaster is the Executive Director of Mission Scholars, a program of the Santa Barbara Education Foundation.

on Google

on Google

You must be logged in to post a comment.